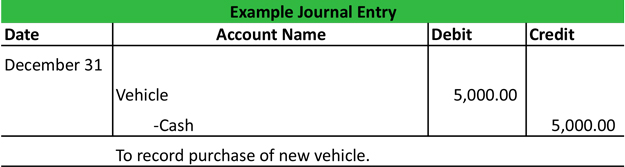

When transactions are to be recorded, the accounting debit and credit rules have to be applied. Securities and Exchange Commission ( SEC). It also aids in ensuring that the Generally Accepted Accounting Principles (GAAP) are followed when preparing reports that will be filed with the U.S. This journal entry is made to track transactions and to ensure that when making financial reports, all transactions are well captured and accurately reported. When companies pay rent in advance, they record the transaction by making a journal entry.

Journal entries for prepaid rent as debit or credit See also: Utilities payable debit or credit? Now that we have understood what prepaid rent means and how it can be accounted for, let us see whether prepaid rent is a debit or credit.

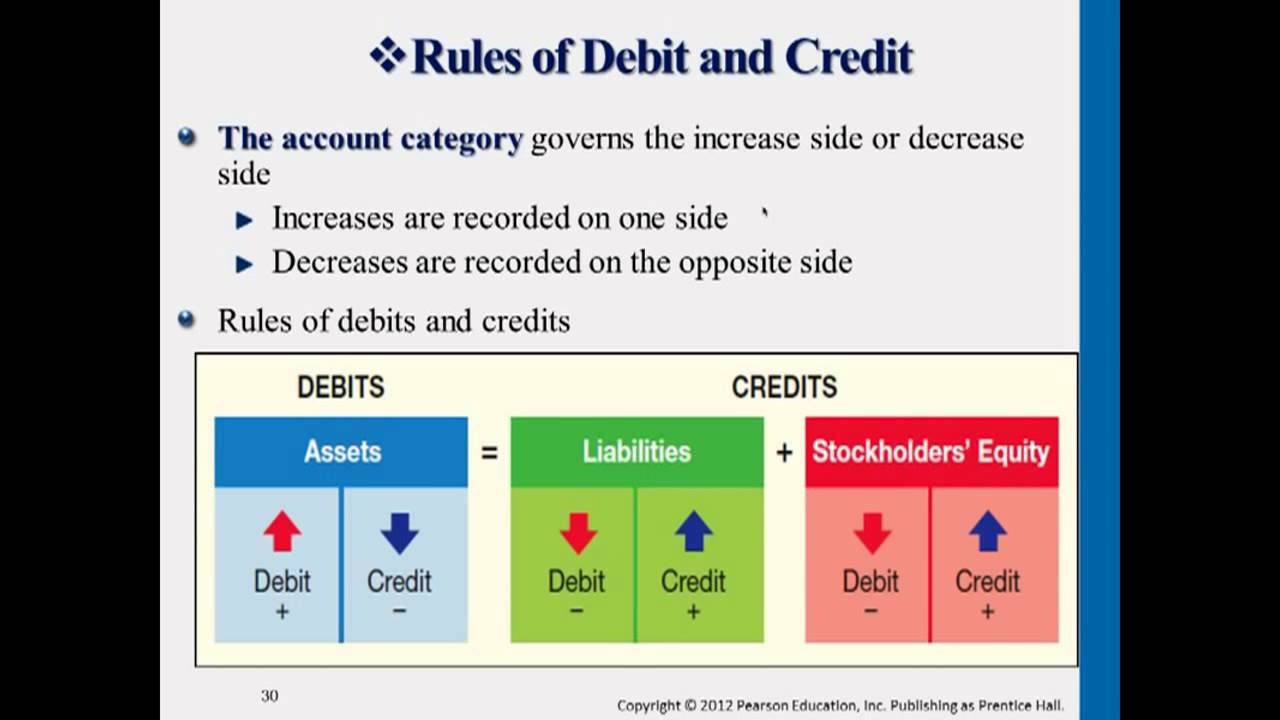

If the cash accounting method is used, the amount is recorded within the accounting period for which the rent is used up. Most companies however use the accrual accounting method.įor prepaid rent, if the accrual accounting method is used, it will be first recorded as prepaid rent and then moved to the rent expense account once it gets to the period for which the prepayment was made. They can either use the accrual accounting method which recognizes the expense once it has been used irrespective of payments being made or not or the cash accounting method which only recognizes expense when it has been paid for. Is prepaid rent debit or credit? Accounting for prepaid rentĬompanies have two options when it comes to keeping a record of the transactions they make. When the benefits are realized by the company, prepaid rent is then recognized as an expense. Since the prepaid rent has future economic benefits to the company before they get expensed, they are first considered assets. Simply put, prepaid expenses are expenditure payments for rent that are paid in one accounting period and expensed in a different period. When the rental period that was prepaid for reaches, the company will reduce the prepaid rent account and record the expense. Thus, when businesses make lease payments earlier than they are used, they get recorded as prepaid rent. The main indicator for prepaid rent is the timing. Before we discuss prepaid rent as debit or credit, let us have a look at what it means. Since businesses usually make journal entries for all transactions carried out, it is necessary to understand whether prepaid rent is a debit or a credit so that errors will be avoided when recording it. This prepayment gets recorded as an expense on the company’s income statement once the period for which the prepayment was made elapses. When a prepayment is made for rent, the company records it as an asset on its statement of financial position along with other prepaid expenses in the current assets section. This prepayment is referred to as prepaid rent. Generally, companies who lease buildings for their operations make a prepayment to the owner of the building. The payments made to the landlord are called rent. If this building is not owned by the company, it means they will have to make payments to the owner of the building for using the building. Is prepaid rent debit or credit? In order to operate their business, companies usually need a building to use as their office, warehouse, or manufacturing plant. Prepaid rent is a debit and not a credit.Examples of prepaid rent as debit and credit.

0 kommentar(er)

0 kommentar(er)